Are You Eligible to Reduce Your Interest Expense?

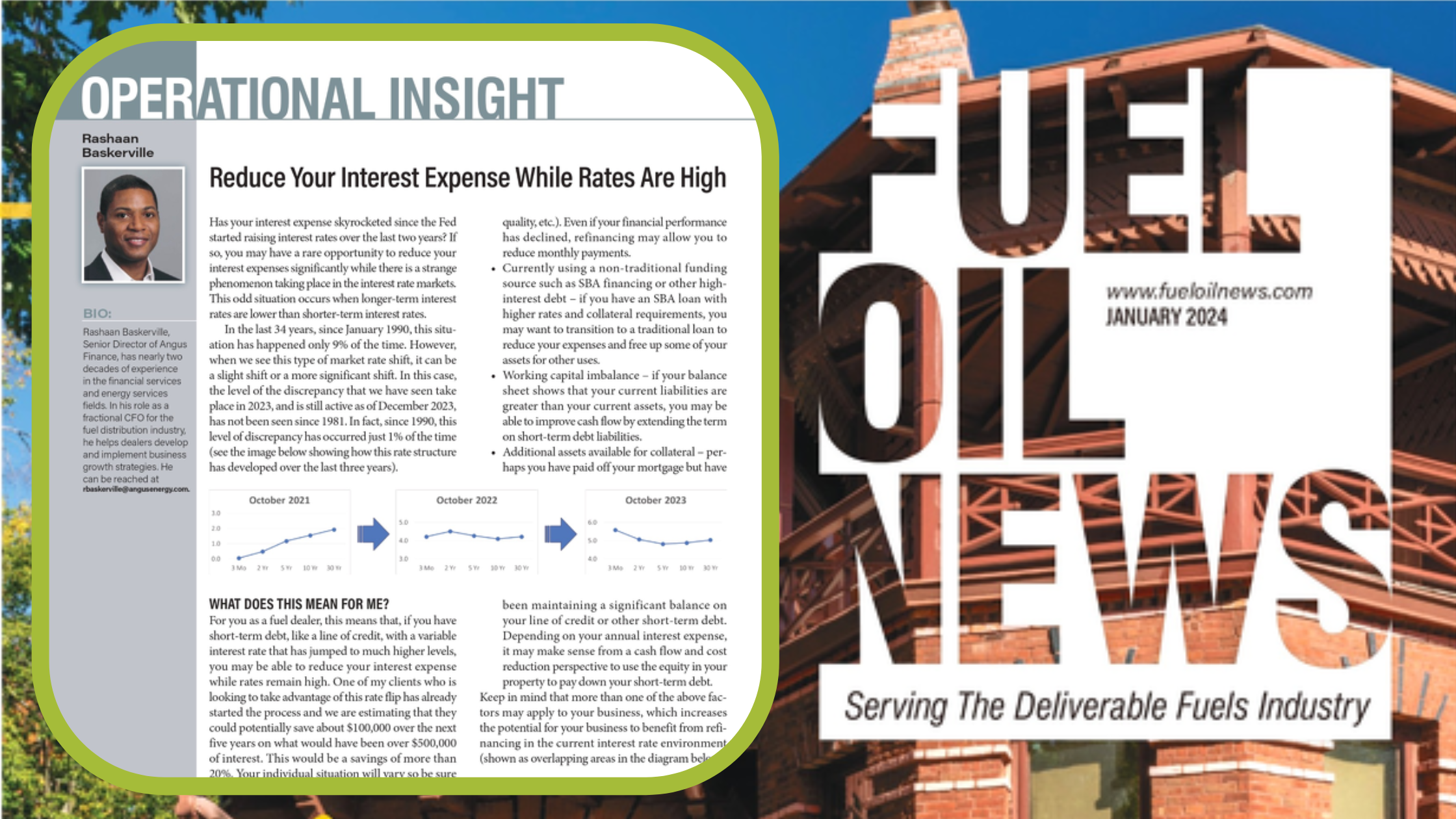

Has your interest expense skyrocketed since the Fed started raising interest rates? If so, there is a strange phenomenon taking place in the interest rate markets that may provide you with a rare opportunity to reduce your interest expenses significantly. This odd situation occurs when longer-term interest rates are lower than shorter-term interest rates (image below illustrates how this rate structure has developed over the last three years).

What does this mean for me?

For you as a fuel dealer, this means that, if you have short-term debt, like a line of credit, with a variable interest rate that has jumped to much higher levels, you may be able to reduce your interest expense while rates remain high. By refinancing your debt along the flipped interest rate curve, you have the potential to free up cash flow and save on your annual interest expenses.

Who can benefit the most?

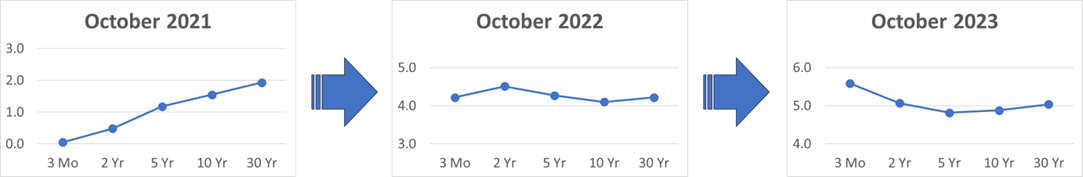

Here are some of the key indicators of businesses that can benefit from refinancing variable rate debt:

- Change in financial circumstances (larger asset base, improved operating performance, improved collateral quality, etc.). Even if your financial performance has declined, refinancing may allow you to reduce monthly payments.

- Currently using a non-traditional funding source such as SBA financing or other high-interest debt (e.g., you have an SBA loan with higher rates and collateral requirements).

- Working capital imbalance – if your balance sheet shows that your current liabilities are greater than your current assets, you may be able to improve cash flow by extending the term on short-term debt liabilities.

- Additional assets available for collateral (e.g., you have paid off your mortgage but have been maintaining a significant balance on your line of credit or other short-term debt).

Keep in mind that more than one of the above factors may apply to your business, which increases the potential for your business to benefit from refinancing in the current interest rate environment (as referenced in the overlapping areas in the diagram shown on the right).

Additional considerations

- Shop around – you may be tempted to take the first refinancing offer you receive, particularly if it is from your existing bank, however you may find a better offer by keeping your options open.

- Be prepared – when you are speaking with banks about refinancing, make sure to have a thorough understanding of your business financials and be able to explain your needs from the bank’s point of view.

- Consider the full picture – there can be other benefits to refinancing besides the current potential for a lower interest rate, however, there are also potential additional costs for refinancing. Consult your financial advisor to do a full analysis before moving forward.

Why now?

As mentioned above, the current situation with longer-term interest rates being lower than shorter-term interest rates is very uncommon, particularly at the levels we have seen recently. The Fed recently decided to hold interest rates steady and there are some people who expect the Fed to begin cutting interest rates as soon as 2024. However, if economic conditions improve faster than expected, inflation heats up again or remains above target levels, or both situations occur, then interest rates may remain higher for longer and could even increase further.

If you conclude that you can save money or improve cash flow by refinancing now, you may regret missing the opportunity if you pass based on a forecast that never materializes. You can get free quotes from multiple banks before making a final decision on how to proceed, so the risk to explore refinancing is minimized, while the upside could be substantial.

The above is an abridged version of “How to Reduce Your Interest Expense While Rates Are High” by Rashaan Baskerville (Sr. Director of Angus Finance), published in the January 2024 issue of Fuel Oil News.