June 17, 2024

The article “Navigating Propane Market Volatility” written by Phil Baratz (published in BPN, June 2024) explores the key strategies that enable retail propane distributors to confidently navigate uncertainty and thrive in a dynamic market.

June 2, 2024

There are ways to hedge Basis risk and they can include working with a supplier or working with a “paper hedge.” It is not something to panic about, but ignoring DIFFs is at your own peril.

April 1, 2024

The days of continually raising prices to maintain profits are long gone; survival in today's cutthroat market demands streamlined operations and competitive pricing models. Keeping customers can be as simple as offering the RIGHT pricing program...

January 21, 2024

How do we retain customers? Start by looking closely at your most loyal customers and see what they have in common. As we’ve studied over 500,000 customers from over 150 dealers, we’ll give you a hint: The most loyal customers are the ones on Price Cap Programs! Wondering how you can introduce this powerful tool to your customer base or how it’s offered, hedged and tracked? Read more...

October 25, 2023

Angus Energy is proud to announce that Nicolas Pintabona has joined the company as an Account Executive, Hedging. In this role, Nick will be focused on helping us leverage hedging opportunities for our current client list as well as helping to expand our footprint in the Northeast.

October 6, 2023

When considering whether to hedge (or not to), it is important to review the following key factors: Variable Cost Structure: , Fixed Cost Structure, Inflation, and Interest Rates.

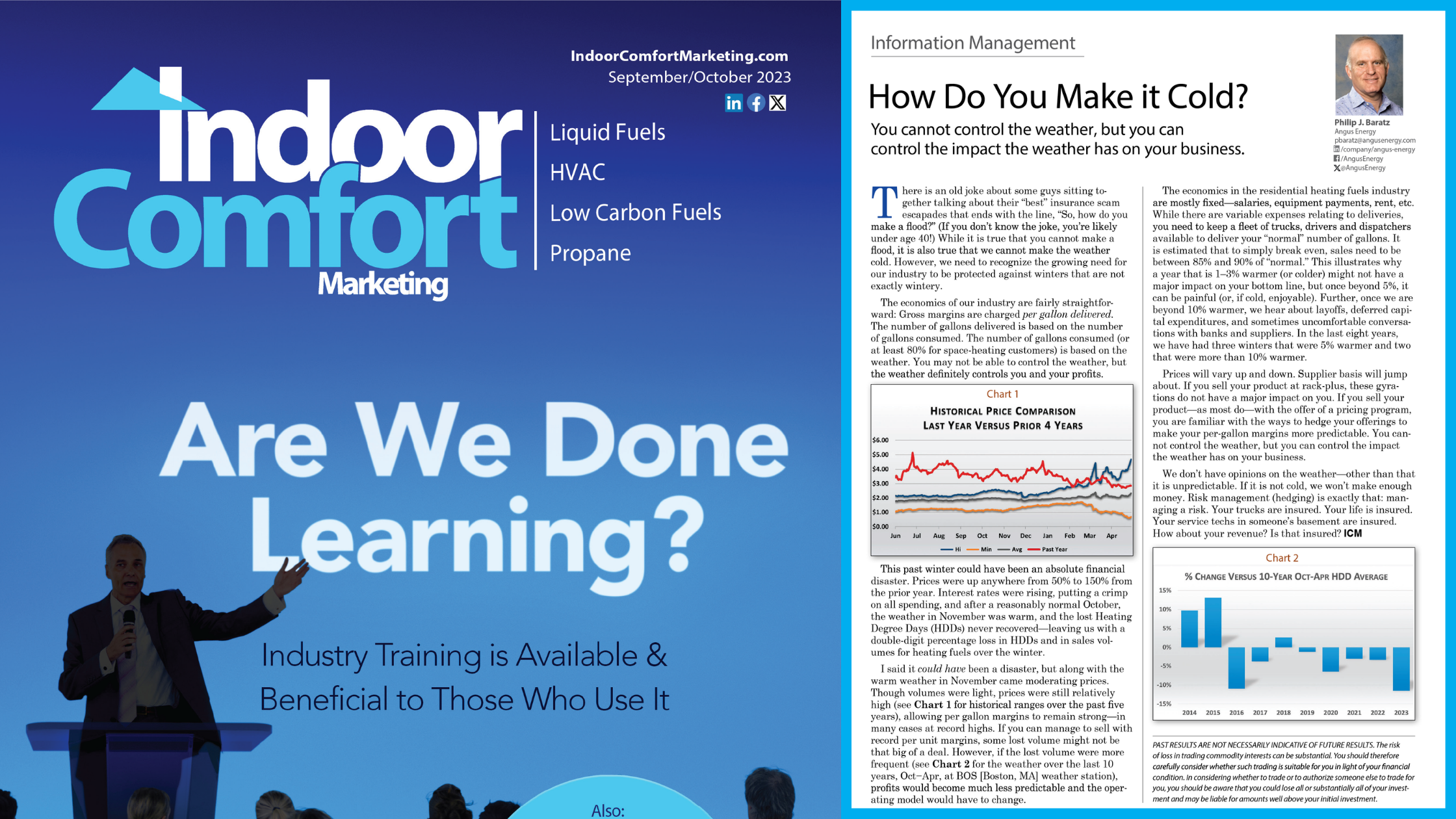

September 6, 2023

How Do You Make it Cold? You cannot control the weather, but you can control the impact the weather has on your business. There is an old joke about some guys sitting together talking about their “best” insurance scam escapades that ends with the line, “So, how do you make a flood?” (If you don’t…

July 25, 2023

All the planning in the world cannot help you sell more gallons when Mother Nature does not cooperate. When winters are warm, temperatures are what affect your sales. NOT planning, pricing, service or marketing efforts. There is a way, however, to generate revenue during a warm winter… Hedging the volume through “option purchases” on the number of heating degree days (HDDs) in your area.

January 30, 2023

There is an aphorism in the academic world that says, “publish or perish” in reference to advancing a career. Our aphorism is Hedge or Perish.

January 1, 2023

Basis Risks are Here to Stay... For the past 30 years companies have been offering pricing programs (fixed and capped), to give their customers peace-of-mind, maximize company sales margins, and minimize customer attrition.