How Do You Make it Cold?

You cannot control the weather, but you can control the impact the weather has on your business.

There is an old joke about some guys sitting together talking about their “best” insurance scam escapades that ends with the line, “So, how do you make a flood?” (If you don’t know the joke, you’re likely under age 40!) While it is true that you cannot make a flood, it is also true that we cannot make the weather cold. However, we need to recognize the growing need for our industry to be protected against winters that are not exactly wintery.

The economics of our industry are fairly straightforward: Gross margins are charged per gallon delivered. The number of gallons delivered is based on the number of gallons consumed. The number of gallons consumed (or at least 80% for space-heating customers) is based on the weather. You may not be able to control the weather, but the weather definitely controls you and your profits.

This past winter could have been an absolute financial disaster. Prices were up anywhere from 50% to 150% from the prior year. Interest rates were rising, putting a crimp on all spending, and after a reasonably normal October, the weather in November was warm, and the lost Heating Degree Days (HDDs) never recovered—leaving us with a double-digit percentage loss in HDDs and in sales volumes for heating fuels over the winter.

I said it could have been a disaster, but along with the warm weather in November came moderating prices. Though volumes were light, prices were still relatively high (see price chart with historical ranges over the past 5 years), allowing per gallon margins to remain strong – in many cases at record highs. If you can manage to sell with record per unit margins, some lost volume might not be that big of a deal.

I said it could have been a disaster, but along with the warm weather in November came moderating prices. Though volumes were light, prices were still relatively high (see price chart with historical ranges over the past 5 years), allowing per gallon margins to remain strong – in many cases at record highs. If you can manage to sell with record per unit margins, some lost volume might not be that big of a deal.

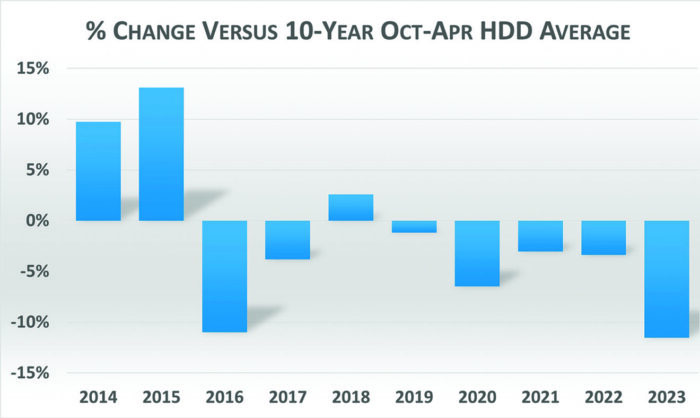

However, if the lost volume were more frequent (see HDD chart – last 10 years, Oct-Apr, at BOS weather station), profits would become much less predictable and the operating model would have to change.

However, if the lost volume were more frequent (see HDD chart – last 10 years, Oct-Apr, at BOS weather station), profits would become much less predictable and the operating model would have to change.

The economics in the residential heating fuels industry are mostly fixed – salaries, equipment payments, rent, etc. While there are variable expenses relating to deliveries, you need to keep a fleet of trucks, drivers and dispatchers available to deliver your “normal” number of gallons. It is estimated that to simply break even, sales need to be between 85% and 90% of “normal.” This illustrates why a year that is 1–3% warmer (or colder) might not have a major impact on your bottom line, but once beyond 5%, it can be painful (or, if cold, enjoyable). Further, once we are beyond 10% warmer, we hear about layoffs, deferred capital expenditures, and sometimes uncomfortable conversations with banks and suppliers. In the last eight years, we have had three winters that were 5% warmer and two that were more than 10% warmer.

Prices will vary up and down. Supplier basis will jump about. If you sell your product at rack-plus, these gyrations do not have a major impact on you. If you sell your product – as most do – with the offer of a pricing program, you are familiar with the ways to hedge your offerings to make your per-gallon margins more predictable. You can- not control the weather, but you can control the impact the weather has on your business.

We don’t have opinions on the weather – other than that it is unpredictable. If it is not cold, we won’t make enough money. Risk management (hedging) is exactly that: managing a risk. Your trucks are insured. Your life is insured. Your service techs in someone’s basement are insured. How about your revenue? Is that insured?

Written by Philip J. Baratz. This article was originally published in the September/October 2023 issue of Indoor Comfort Marketing.