PCE Affects Your Interest Rates. Do You Know What It Is?

Did you know that the Federal Reserve (Fed) does not use the Consumer Price Index (CPI) to track inflation? We so often hear about the latest CPI trend on the news and how it compares to the Fed inflation target of 2%, however CPI is the wrong measure to look at. The Fed prefers to track a much less familiar index known as Personal Consumption Expenditures (PCE).

While CPI focuses on the change in prices of a fixed basket of goods and services, PCE measures the change in consumer spending on the actual goods and services that households are currently purchasing. PCE is more flexible and considers substitutions made by households. For example, if the price of beef is rising rapidly due to a shortage, consumers may start buying more chicken instead. The PCE would capture these changes, whereas the CPI would not.

This is the reason that the Fed prefers the PCE over the CPI, because it more accurately reflects the impact of changes in prices on household economics and, hence, the true impact of inflation. The specific version of PCE that the Fed tracks is known as core PCE, which excludes food and energy. As noted above, the Fed’s long-term target for PCE inflation is 2%.

The latest measurement of PCE was 2.9% as of December 2023, which was nearly 50% higher than the Fed’s long-term target. According to the latest briefing by Fed Chair Jerome Powell, “inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain. I want to assure the American people that we are fully committed to returning inflation to our 2% goal.” And although the Fed no longer seems to foresee the need to raise interest rates, there is a clear intent to take a cautious approach to making any rate cuts.

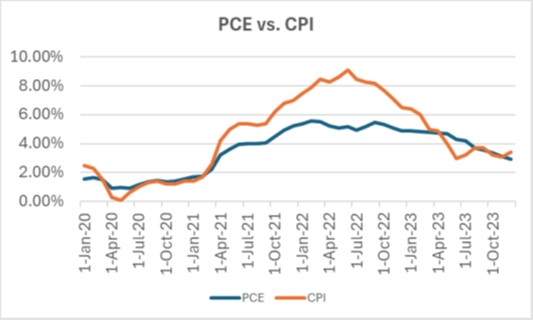

Based upon the chart below, we can see that inflation rates according to both PCE and CPI have been trending down.

However, the Fed’s latest projections for core PCE show that inflation is expected to remain above 2% through 2026, reaching 2.05%. So, what does that mean for the future of interest rates? While the Fed is making it clear that the process of rate cutting will be slow, we could still see a decrease this year. However, market expectations that were indicating six rate cuts this year seem less and less likely with each Fed meeting.

The above article was written by Rashaan Baskerville and originally appeared in the March/April Issue of Fuel Oil News.