Is Basis (aka DIFF) a Big Deal?

Of all the methods used by fuel distributors to retain customers, perhaps the most compelling is the “pricing program.” It’s clear from the numbers that Capped Price programs perform better than Fixed Price offers from a retention perspective. However, program offers can be catastrophic for dealers who fail to acknowledge and address the risks of utilizing these great retention tools.

In protecting yourself (by hedging) from the offers you make to your customers, there are three critical items that need to be understood and addressed:

- The Merc (or forward) price of oil

- The “DIFF” that you pay to your supplier (higher or lower than the Merc price)

- The volume you will need to deliver (and purchase) based on the “actual” weather (not the “normal” weather)

I want to focus on the DIFF. The DIFF*, also referred to as “the basis” or “the spread,” is unique in that the correlation between the price of oil and the DIFF is often-times seemingly illogical.

You can look at the DIFF in a few ways, but mostly it represents the profit that the wholesaler/supplier earns for their services (granting credit, providing storage, transporting product to their terminal, etc.). A big consideration for the price you will pay, including the supplier markup, is the “spot” price of oil, as opposed to the Merc (futures) price. As you would imagine, when inventories are high, the DIFF should be lower than when supply is low.

A good proxy for the forward DIFF is the spread between futures contracts from one month to the next. If you think of futures contracts as individual prices for delivery of oil at set times in the future, the individual prices are telling you part of a story and the spread between the prices is telling you the whole story (or at least the whole story at that time).

When inventories are full and prices are falling (think the beginning of the COVID-19 pandemic), the DIFFs are low in that each successive month is higher priced than the prior month, i.e., December futures were at a premium to November futures. However, when supply gets tight or there are other geopolitical issues driving prices up, you can face the opposite situation where the subsequent month (December in our example) is discounted to the former month.

Does all this matter and, if so, how much does it matter?

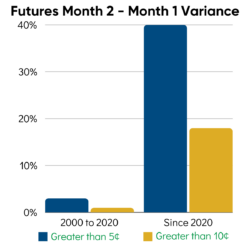

Over the past 23+ years (dating back to 2000), the spread between the first month of Merc futures and the second month of Merc futures was within 5¢ per gallon ~97% of the time. From 2000 to 2020 (nearly 5,000 days of trading), the spread exceeded 5¢ 137 times (<3%) and exceeded 10¢ 26 times (<1%). In the three years since 2020, the spread has exceeded 5¢ 326 times (40% of the time) and exceeded 10¢ 146 times (18% of the time).

Over the past 23+ years (dating back to 2000), the spread between the first month of Merc futures and the second month of Merc futures was within 5¢ per gallon ~97% of the time. From 2000 to 2020 (nearly 5,000 days of trading), the spread exceeded 5¢ 137 times (<3%) and exceeded 10¢ 26 times (<1%). In the three years since 2020, the spread has exceeded 5¢ 326 times (40% of the time) and exceeded 10¢ 146 times (18% of the time).

Therefore, yes, it matters! When the spreads swing by a nickel, a dime, or in some cases much more, the costs to you to stand behind your pricing program can be at risk!

There are ways to hedge DIFF/Basis/Spread risk and they can include working with a supplier or working with a “paper hedge.” It is not something to panic about, but ignoring DIFFs is at your own peril. Look into it and make the right decision for your company and risk tolerance.

*Hedging against a change in Merc prices and assessing the benefits of weather hedges to protect against weather variations are also very important.

This article was originally published in Indoor Comfort Marketing (May/June 2024 issue) and was written by Phil Baratz. Click Here to view the original article.

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you considering your financial condition. In considering whether to trade or to authorize someone else to trade for you, you should be aware that you could lose all or substantially all your investment and may be liable for amounts well above your initial investment.